SwingTradingWangQingy

No content yet

SwingTradingWangQingy

Whose general is this, so brave!

View Original

- Reward

- like

- Comment

- Repost

- Share

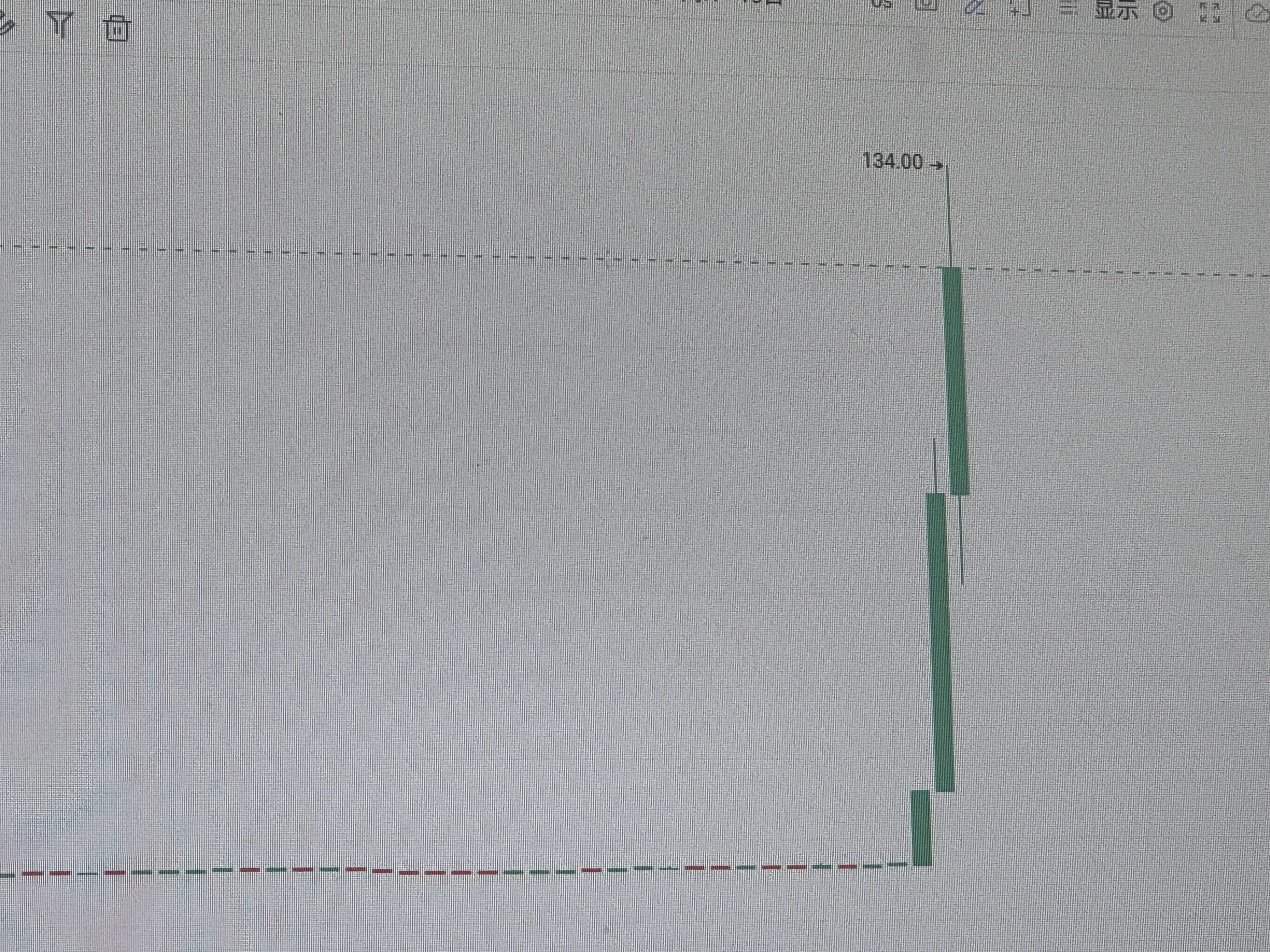

The opening was so quick, with a short-term fluctuation of 500 points in the market, very smooth and comfortable!

View Original

- Reward

- like

- Comment

- Repost

- Share

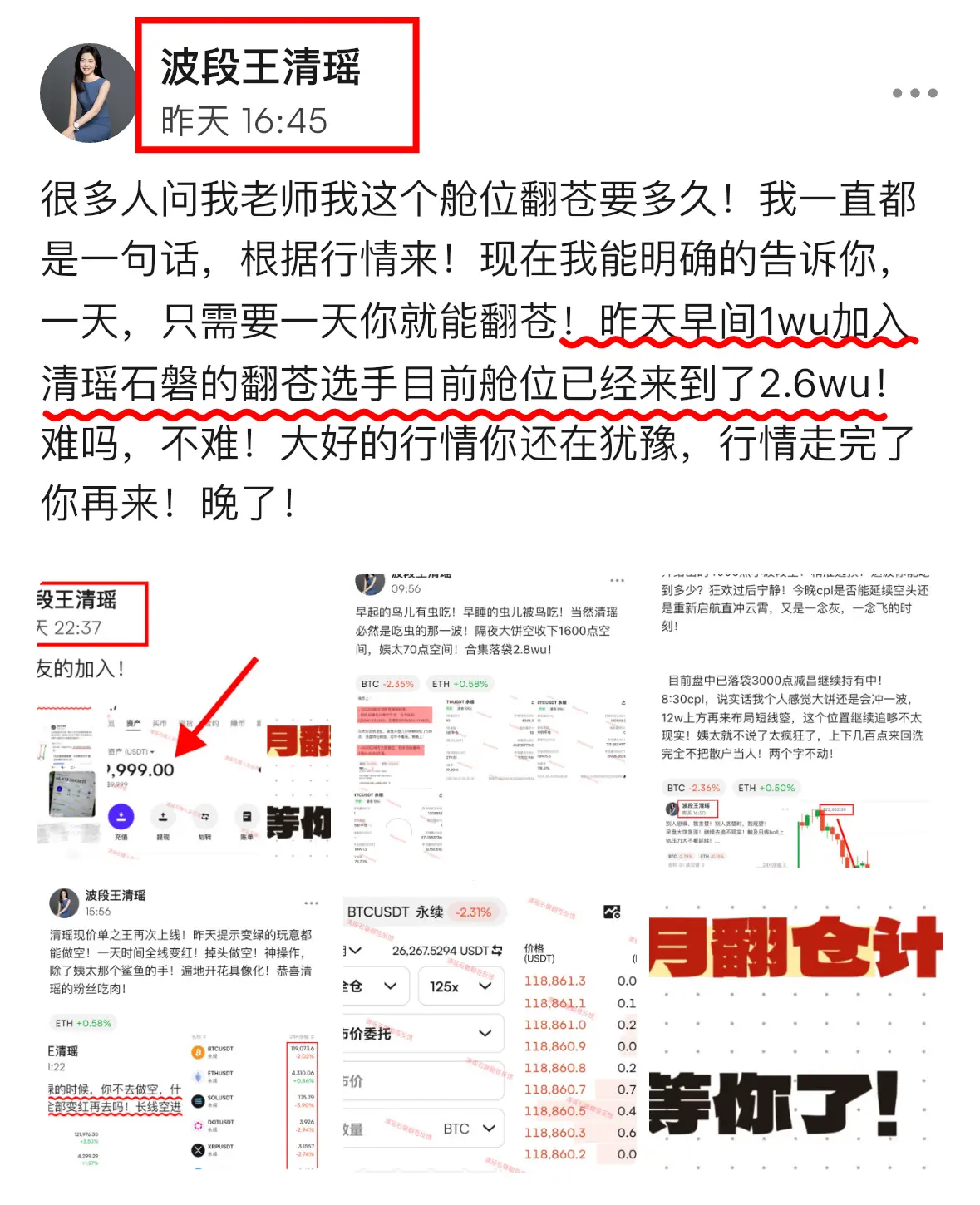

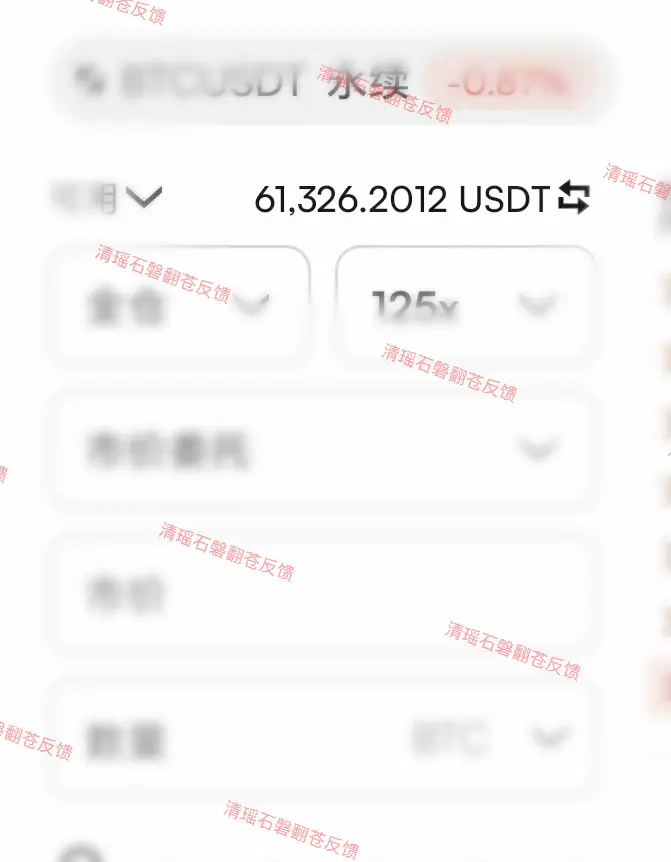

Do you think only Hangqing is rising? The cabin position of the Cangxuan player has also been in green! Yesterday 2.6wu, today 6.1wu! Two words, nailed it!

View Original

- Reward

- like

- Comment

- Repost

- Share

cpl data Hangqin fully absorbed, the long positions from yesterday and the overnight shorts once again targeted the 1200 point space, securing 10000 profit! New fren also achieved a 4️⃣ consecutive profit!

View Original

- Reward

- like

- Comment

- Repost

- Share

Today's market clearly continues to short squeeze and pump, not giving any breathing opportunities. After all, the space on the daily chart and weekly chart has opened up. Once the breakout occurs, we will continue to look bullish above the position of top-bottom conversion. Next, it's about watching the strength of the continuation. On Wednesday, continue to look for a breakout.

In the morning, focus on the short-term Bitcoin near 118500-119200 to continue buying, with a target of 122000!

In the morning, focus on the short-term Bitcoin near 118500-119200 to continue buying, with a target of 122000!

BTC1.03%

- Reward

- like

- Comment

- Repost

- Share

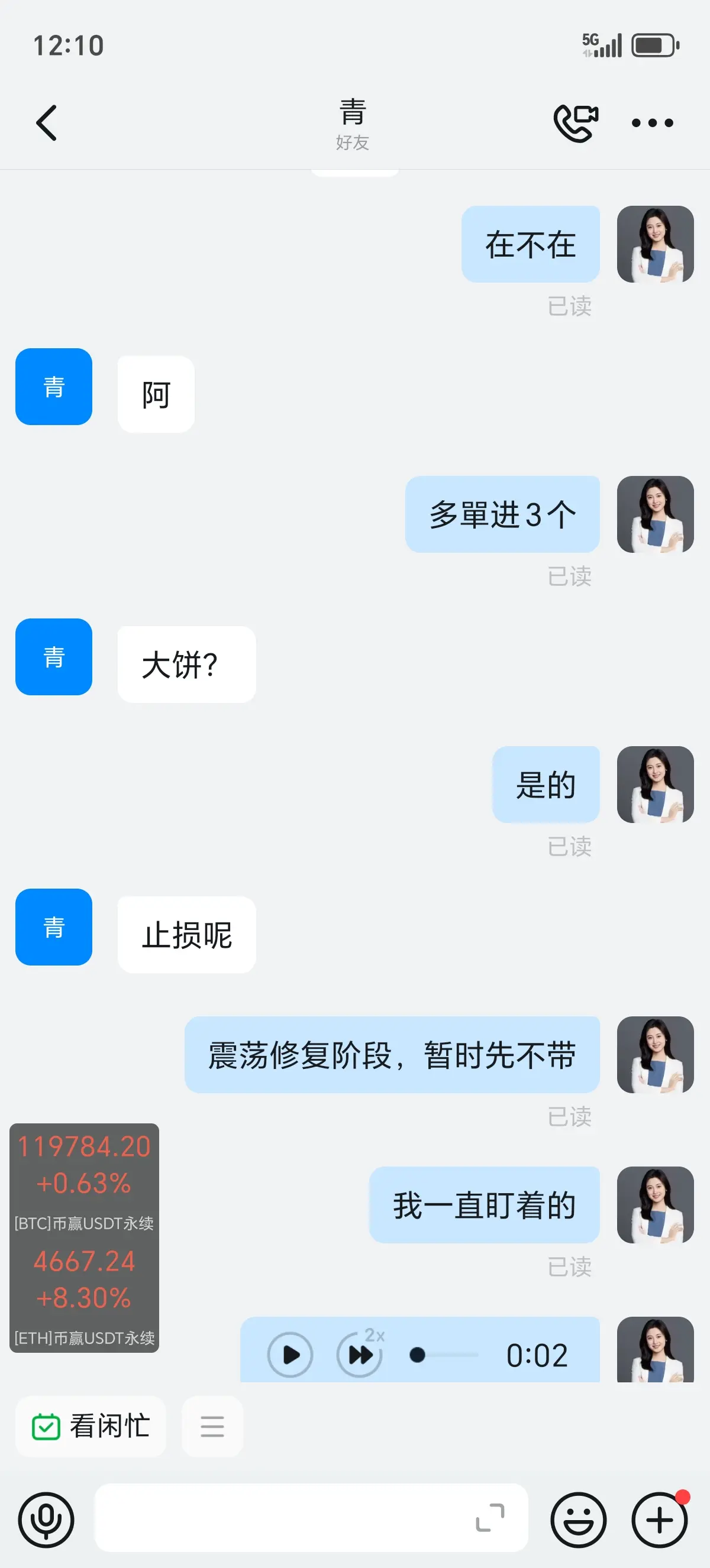

Another thrilling night! After exiting the overnight short order on Tuesday, we entered a phase of consolidation and recovery. The after-hours cpl Qingyao also provided a bullish outlook in advance! Tuesday was another day where the market followed the strategy! BTC closed with a space of 4200 points, and ETH synchronized with a space of 230 points! I won't say much about swing trading, just two words: precise!

View Original

- Reward

- 1

- Comment

- Repost

- Share

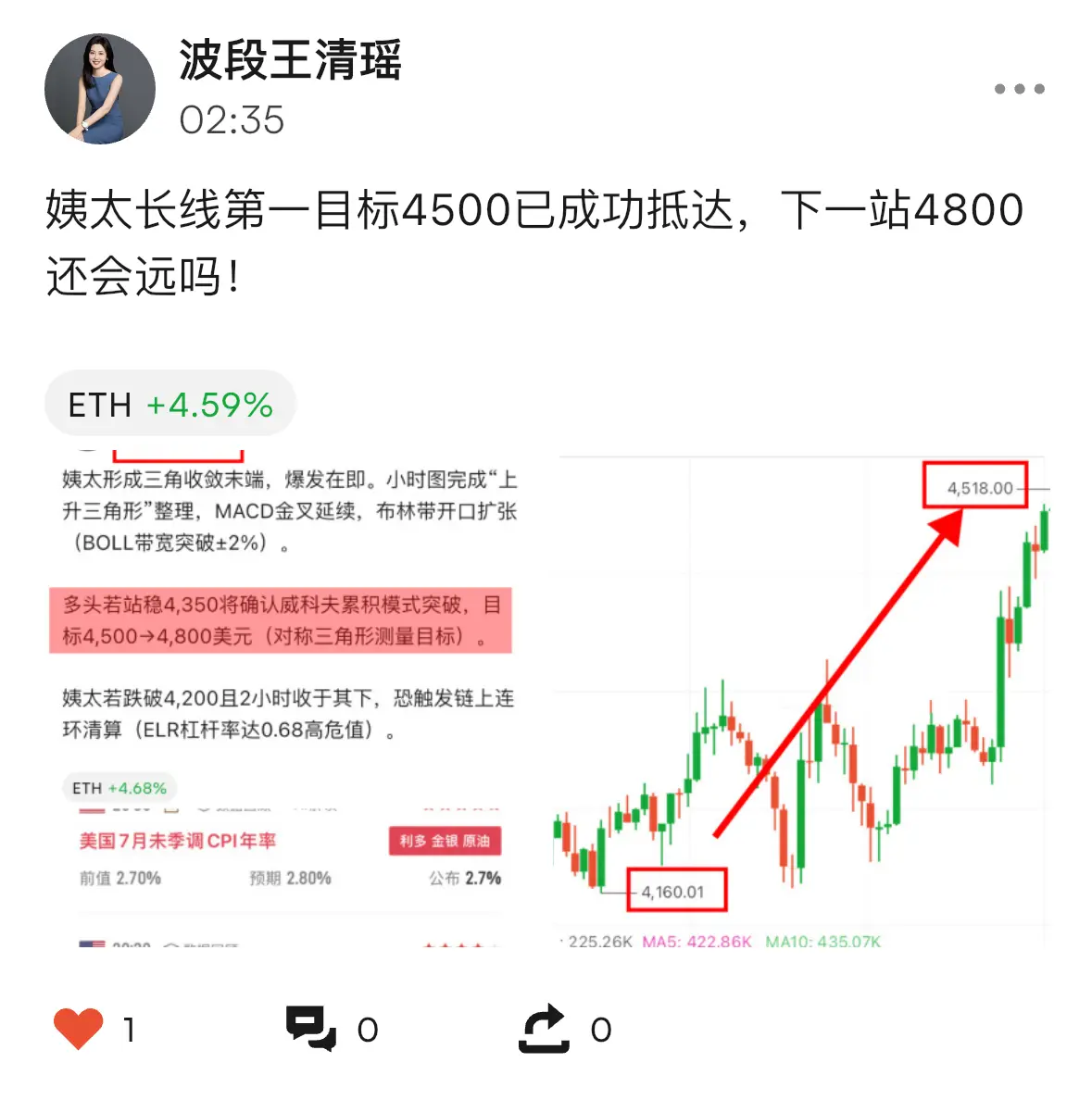

ETH long term first target 4500 has successfully arrived, is the next stop 4800 still far?

ETH7.31%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

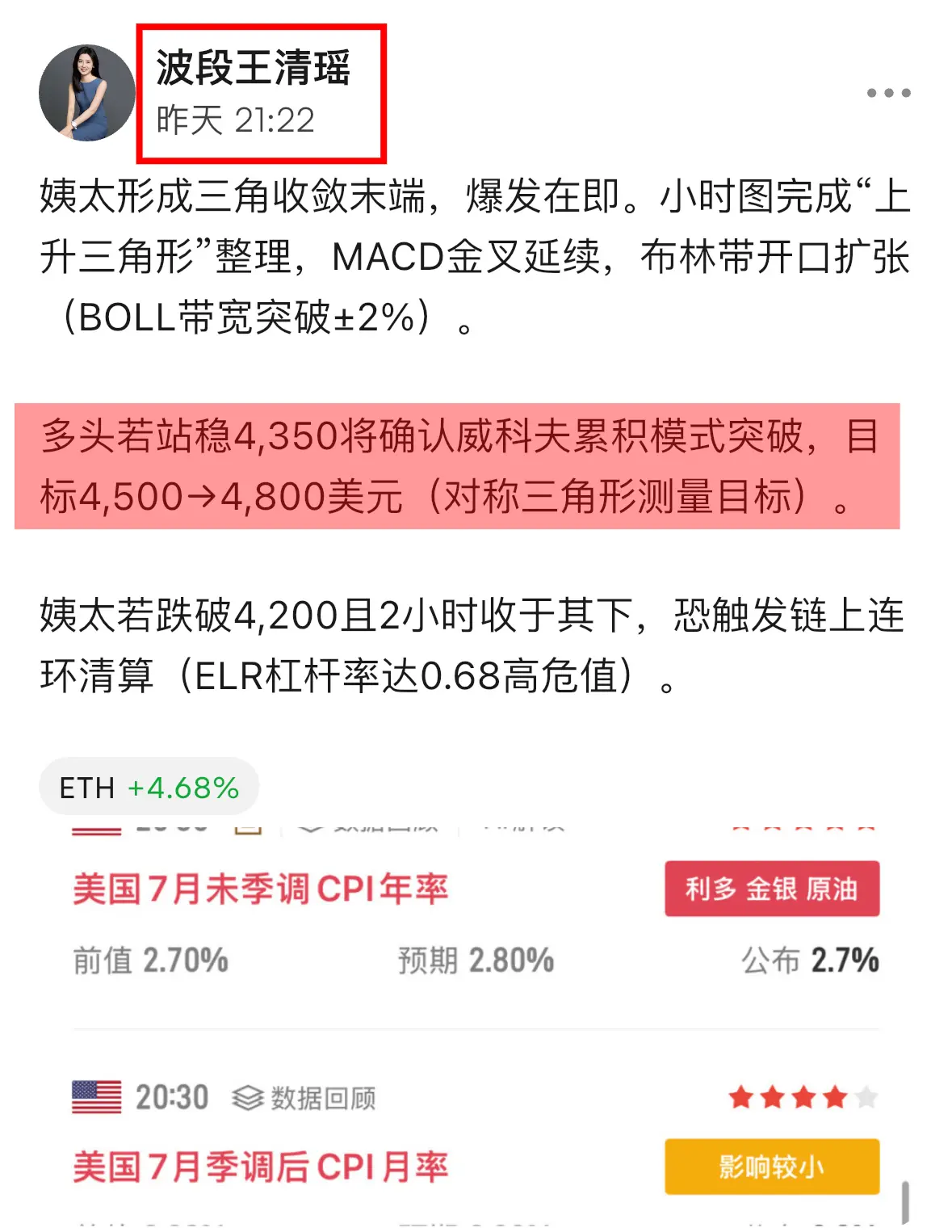

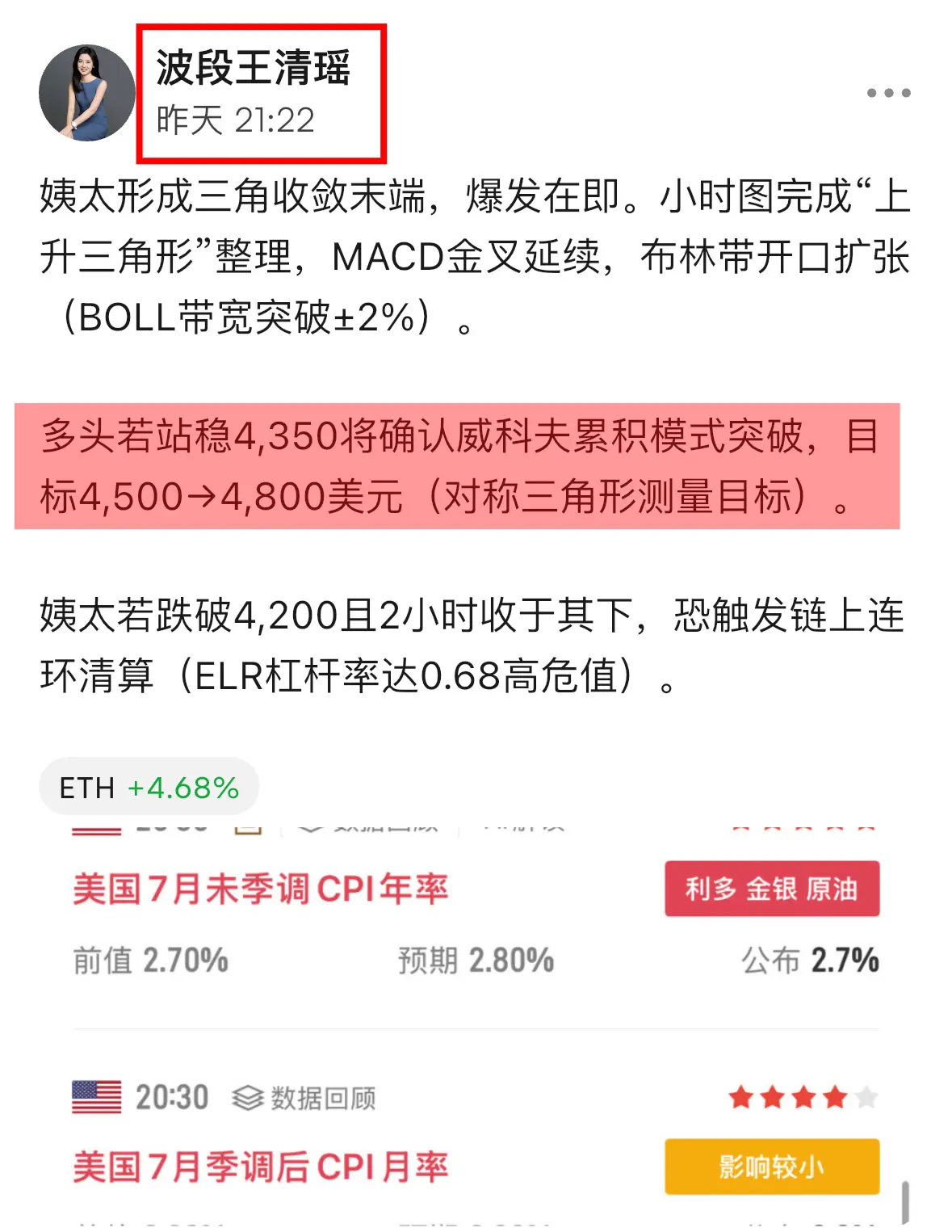

ETH forms a triangle convergence at the end, an explosion is imminent. The hourly chart completes an "ascending triangle" consolidation, MACD golden cross pattern continues, and the Bollinger Bands open up (BOLL bandwidth breaks ±2%).

If the bulls stabilize above 4,350, it will confirm the breakout of the Wyckoff accumulation pattern, targeting 4,500→4,800 USD (measured target of the symmetrical triangle).

If ETH breaks below 4,200 and closes under it for 2 hours, it may trigger a chain liquidation (ELR leverage ratio reaches a high-risk value of 0.68).

If the bulls stabilize above 4,350, it will confirm the breakout of the Wyckoff accumulation pattern, targeting 4,500→4,800 USD (measured target of the symmetrical triangle).

If ETH breaks below 4,200 and closes under it for 2 hours, it may trigger a chain liquidation (ELR leverage ratio reaches a high-risk value of 0.68).

ETH7.31%

- Reward

- like

- Comment

- Repost

- Share

Coin price speculation

Friends who are still lost in the fog without direction

Qing Yao is online to provide solutions.

If the direction is wrong, efforts are in vain; if the direction is right, you can achieve twice the result with half the effort. It is dangerous when you cannot stop losses in a wrong direction in time.

View OriginalFriends who are still lost in the fog without direction

Qing Yao is online to provide solutions.

If the direction is wrong, efforts are in vain; if the direction is right, you can achieve twice the result with half the effort. It is dangerous when you cannot stop losses in a wrong direction in time.

- Reward

- like

- 1

- Repost

- Share

SleepWeekly :

:

How to joinAlts are experiencing a big pump across the board, and the market is destined to produce a batch of 100x coins. If you invest 100k, you'll end up with 10 million. Whether you can break free from your identification as a loser and become an upper-class person depends on whether you can seize this bull run, brothers!

In the 2025 big bull run, these few coins that are beloved by investors and have stable doubling potential are ones you must know.

1. SOL: Doubling opportunity reappears

SOL is on a strong upward trend. Although it is difficult to replicate the glory of 20 yuan, there is still an op

View OriginalIn the 2025 big bull run, these few coins that are beloved by investors and have stable doubling potential are ones you must know.

1. SOL: Doubling opportunity reappears

SOL is on a strong upward trend. Although it is difficult to replicate the glory of 20 yuan, there is still an op

- Reward

- 13

- 2

- Repost

- Share

GateUser-1bc47427 :

:

come onView More

The prophet is online again! The previous article just mentioned that there would be a wave of pump, with 150 points of space for ETH, and BTC is slightly slower, synchronously providing 1000 points of space! Lock in 20000 profit! The market based on news is to catch one wave and wait for another! Wait for the US stock market to come for layout!

BTC1.03%

- Reward

- like

- Comment

- Repost

- Share

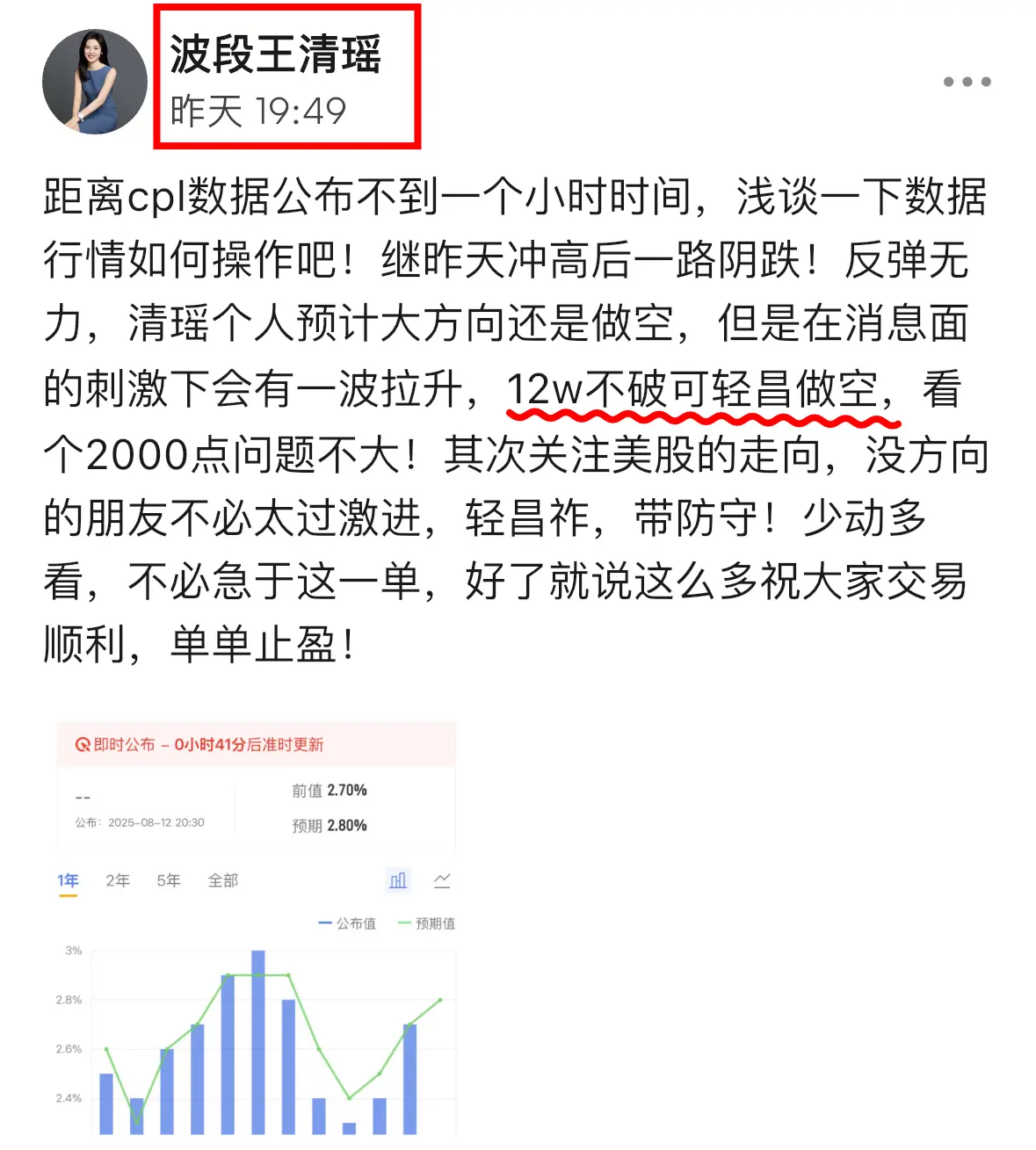

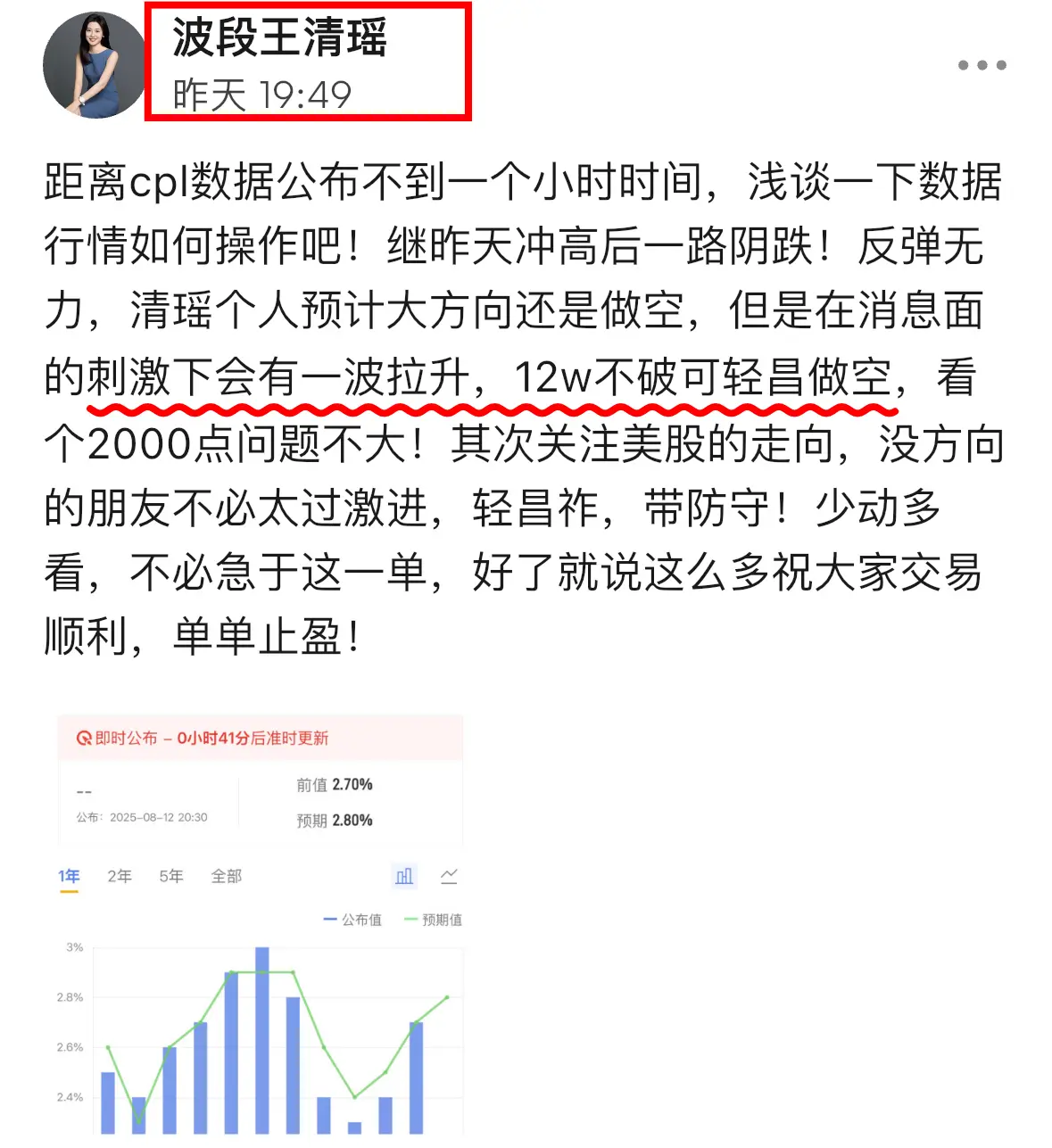

With less than an hour until the CPL data is released, let's briefly discuss how to operate in this market! After yesterday's surge, it has been on a downward movement! The rebound is weak, and I personally expect the overall direction to be shorting. However, there will be a pump due to the stimulus of the news, and as long as it doesn't break 120,000, you can lightly short. Looking at a 2000 point issue shouldn't be a big deal! Secondly, pay attention to the direction of the US stock market. Friends without direction shouldn't be too aggressive, lightly hold, and stay defensive! Move less an

View Original

- Reward

- like

- Comment

- Repost

- Share

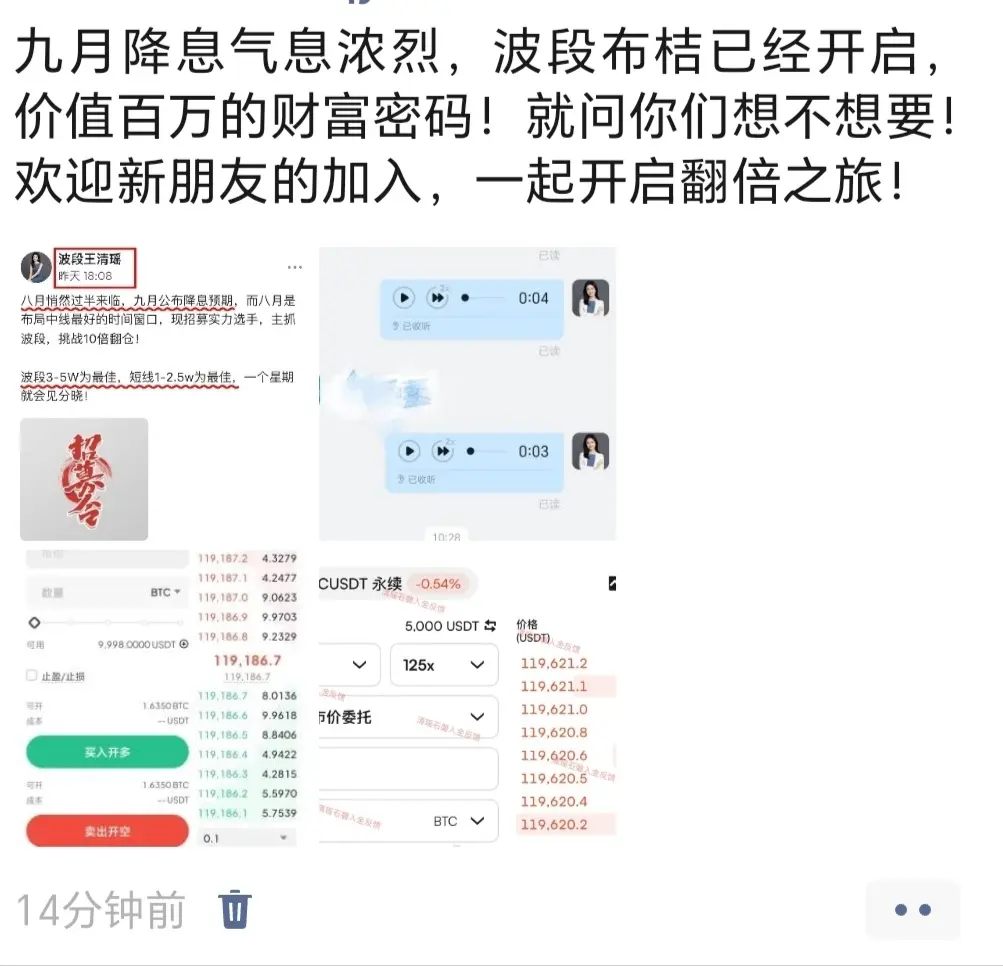

August has quietly passed the halfway mark, and the expectation of interest rate cuts will be announced in September. August is the best time window for laying out medium term strategies. We are currently recruiting strong candidates to focus on swing trading and challenge doubling the position size by 10 times!

Swing trading 30,000-50,000 is the best, short term 10,000-25,000 is the best, and the results will be evident in a week!

View OriginalSwing trading 30,000-50,000 is the best, short term 10,000-25,000 is the best, and the results will be evident in a week!

- Reward

- like

- 1

- Repost

- Share

SleepWeekly :

:

🙋Regarding the predictions for tonight's CPI data and market trends, I have two thoughts to share with everyone for reference only. It should be noted that these two thoughts are only valid for specific values; if the CPI ultimately results in other outcomes, then these analyses will not hold.

When it comes to CPI, U.S. oil prices are a key factor that cannot be ignored, and there is a clear positive correlation between the two. From past data, oil prices in June were higher than in May, which directly led to CPI increasing from 2.4% to 2.7%. However, entering July, oil prices are evidently low

View OriginalWhen it comes to CPI, U.S. oil prices are a key factor that cannot be ignored, and there is a clear positive correlation between the two. From past data, oil prices in June were higher than in May, which directly led to CPI increasing from 2.4% to 2.7%. However, entering July, oil prices are evidently low

- Reward

- 1

- Comment

- Repost

- Share