ETH Price Prediction: Treasury Stocks Outshine ETFs and Emerge as the Market’s New Favorite

ETH Reserve Stocks Lead the Pack

SharpLink Gaming (SBET), BitMine Immersion Technologies (BMNR), and BTCS Inc. (BTCS) have each recently posted gains of 8%, 8%, and 10%. Additionally, major crypto and blockchain companies like Coinbase (COIN), Circle (CRCL), MicroStrategy (MSTR), and Bit Digital (BTBT) also advanced in pre-market trading, rising between 1% and 6%. Notably, BMNR and SBET now rank as the top two publicly listed companies worldwide by Ethereum reserves, holding a combined share of more than 65% of the institutional ETH market.

Are ETH Reserve Stocks Set to Replace ETFs as the Next Investment Strategy?

Market momentum has been driven not just by price appreciation but also by a surge in on-chain Ethereum activity: trading volumes have hit a one-year high, and over 36 million ETH—representing about 30% of the total circulating supply—have been staked. Equally important, the U.S. Securities and Exchange Commission’s (SEC) recent guidance on liquid staking has alleviated certain regulatory concerns, further boosting the appeal of investments within the ETH ecosystem.

Some Wall Street analysts note that ETH reserve stocks are showing distinct advantages in valuation and flexibility, and may gradually supplant spot ETFs as the top choice for ETH allocation. In contrast to passive ETFs, these companies can not only benefit from appreciation in ETH’s price but may also unlock further growth potential through business expansion and capital management strategies.

SharpLink’s Strategic Approach and Market Position

SBET has proven outstanding in ETH holdings, asset efficiency, and liquidity—and has recently expanded its trading depth and market reach via the Injective platform, reinforcing its reputation as the most trusted institutional ETH holder. SharpLink Co-CEO Joseph Chalom recently emphasized that, as a productive asset and platform, Ethereum provides investors with more flexible and diverse value creation opportunities compared to Bitcoin reserve firms.

ETH Price Outlook

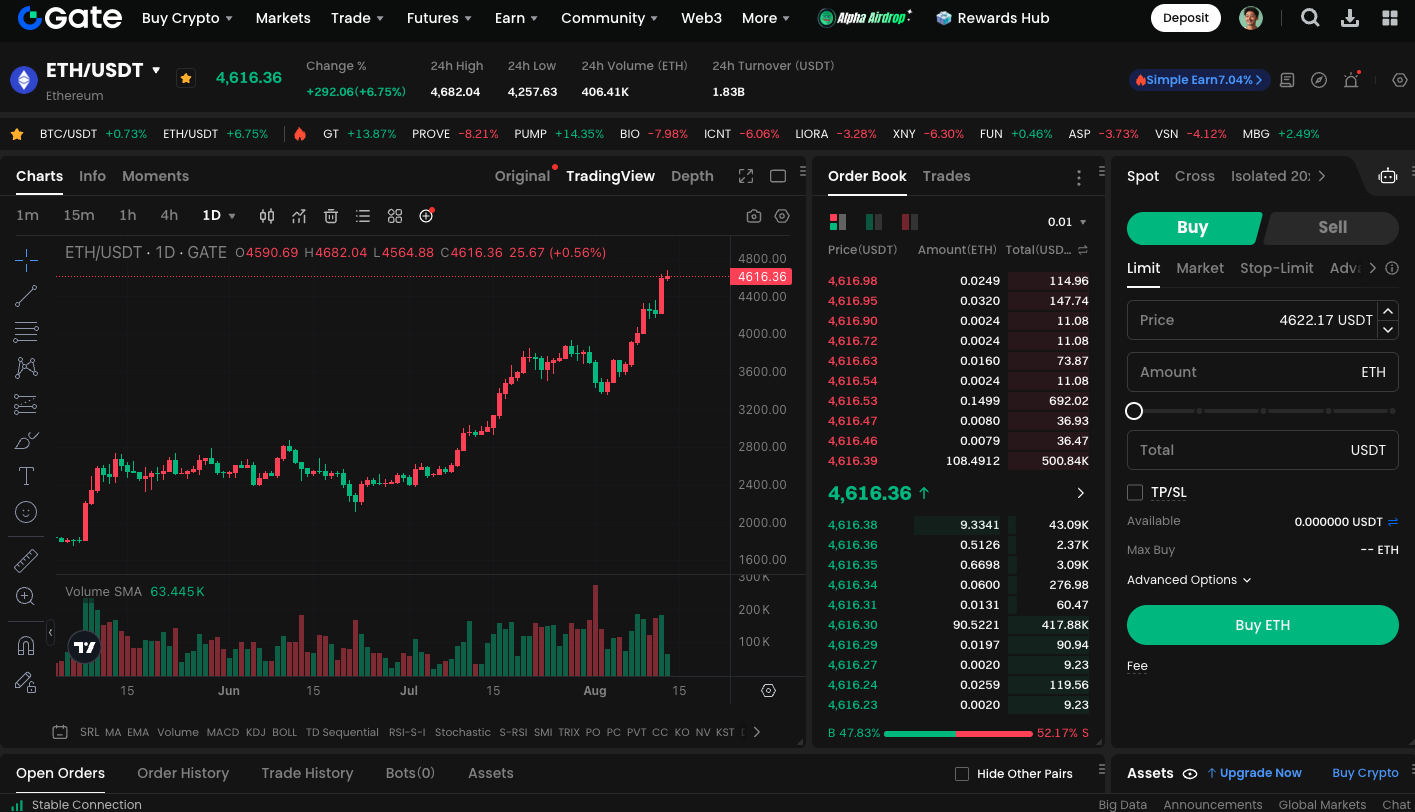

If ETH stays above $4,600, the near-term target range could be $4,800–$5,000; if support fails, the next key levels to watch are $4,500 and $4,350. Over the medium and long term, as institutional holdings and usage of ETH continue to expand, there may be greater room for price appreciation.

Start trading ETH spot now: https://www.gate.com/trade/ETH_USDT

Summary

ETH reserve stocks have shown robust performance lately. With on-chain Ethereum activity at record highs, trading volume at a one-year peak, and more than 36 million ETH staked, ETH’s investment appeal continues to strengthen. Updated SEC guidelines have also eased some regulatory concerns, supporting a more favorable environment for the ETH ecosystem to grow. Investors should monitor these companies and broader market movements to capture opportunities emerging from ETH reserve stocks.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025