$COIN v/s $HOOD: The $160 Billion Battle

There’s a war happening in your pocket, and most people don’t even know it’s going on.

Two of the biggest financial apps in America are conducting completely opposite experiments on millions of users.

Robinhood and Coinbase represent two radically different bets on what people want from money apps. Robinhood ranks #14 in Finance on the App Store, Coinbase at #20. Both are worth around $80 billion.

Both are chasing the same young investors. Both think the other one is doing it wrong.Both are chasing the same young investors. Both think the other one is doing it wrong.

One is betting that people want finance to work like every other app on their phone. Simple, intuitive, and invisible. Coinbase built the infrastructure for the transition from traditional finance to blockchain-based systems.

Both experiments are working. Kind of.

Future of Web3 Won’t Look Like Web3

Seed phrases. Chain switching. Wallet confusion. These aren’t features—they’re roadblocks.

NEAR Foundation is building the infrastructure to fix that.

They’re backing the tools and protocols that make Web3 usable for everyone—not just devs and crypto-natives.

Here’s what that looks like:

- Login with email, self-custody included

- One account across chains and apps

- Gasless transactions and smooth onboarding

- Abstracted chains, no more switching networks

If you’re tired of UX getting in the way of adoption, NEAR is already building the fix.

👉Explore what NEAR Foundation is backing

Here’s the thing about Robinhood and Coinbase. They’re not really competitors in the traditional sense. They’re conducting completely different experiments on the same lab rats (us).

Robinhood looked at finance and said “what if we fixed all the annoying parts?” They give you 15 cryptocurrencies, zero commission trading, and an interface that doesn’t make you feel like you need a finance degree to buy Tesla stocks. Their pitch is that you shouldn’t have to understand how sausage gets made to eat a hot dog.

Coinbase went the opposite direction. They said “what if we rebuilt all of finance on blockchain technology?” Coinbase charges higher fees than competitors like Robinhood, but built its platform for people who want access to the full crypto ecosystem, offering 260+ cryptocurrencies.

They’re betting that traditional finance will eventually move on-chain, and they want to be the infrastructure powering that transition.

“In five- to 10 years, our goal is to be the number one financial services app in the world across those customer segments because we believe that crypto is eating financial services, and we are the number one crypto company,” CEO Brian Armstrong said. “All these asset classes – money market funds, real estate, securities, debt – these are all coming on chain.”

Both companies went public in 2021 within months of each other, both are worth roughly $80 billion, and both are targeting the same generation of phone-first investors. But they might as well be building products for different species.

They’re solving different problems for different users. Which makes this less a war for domination and more a race to serve diverging financial futures?

Both companies are racing to expand their crypto offerings, but they’re approaching it completely differently.

Robinhood’s recent crypto announcements show they’re trying to leapfrog Coinbase entirely. In June, they announced Robinhood Chain, their own layer-2 network that will support tokenised stocks, crypto trading, and eventually private market assets like SpaceX and OpenAI shares.

European users can already trade tokenised versions of US stocks around the clock, not just during market hours. It’s the kind of 24/7 trading that crypto users expect, applied to traditional assets.

They also launched crypto staking for ETH and SOL, acquired Bitstamp (Europe’s oldest crypto exchange) for $200 million, and are planning crypto perpetual futures for European users. They’re building a crypto infrastructure that feels native to their existing stock trading experience, rather than bolting crypto onto a traditional brokerage.

Which is why all of this—the chain, the tokenised stocks, the low fees—is designed to feel natural to the next generation of investors. The ones inheriting trillions.

In the fee war, Robinhood charges around 40 basis points (0.4%) for crypto trades. Coinbase can charge 1.4% or higher for the same trade. If you’re buying $1,000 worth of Bitcoin, that’s $4 on Robinhood versus $14+ on Coinbase.

Robinhood makes this work through payment for order flow. Market makers pay them for the right to execute retail trades, the same way they handle stock trades. It’s a proven model that lets them offer “free” trading while still making money.

But Coinbase offers something Robinhood can’t. Actual crypto ownership. On Robinhood, you’re buying crypto IOUs which are basically a receipt that says Robinhood owes you that amount of crypto. This means you can’t move your Bitcoin to your own wallet or use it anywhere else. You can only buy and sell it within the Robinhood app.

You can’t participate in DeFi, you can’t stake most tokens, and you can’t actually use crypto for anything beyond buying and selling.

For most people, this doesn’t matter. They want crypto exposure, not crypto utility. But for anyone who wants to do anything remotely sophisticated with crypto, Coinbase is the only realistic option among major US platforms.

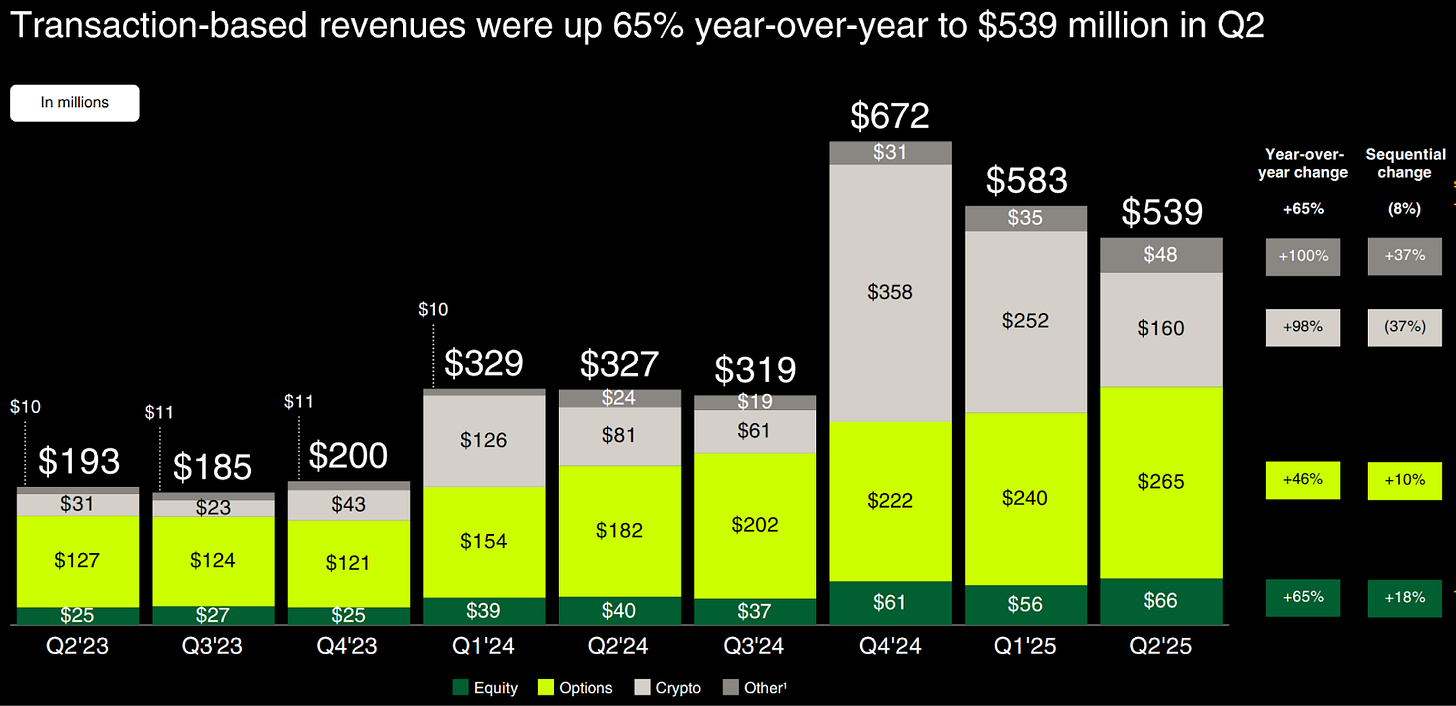

Time to dig into the Q2 numbers.

The earnings from this summer reveal a lot about which approach is working right now.

Robinhood demolished their quarter. Total revenue jumped 45% year-over-year to $989 million. Their crypto revenue specifically exploded by 98% to $160 million (growing from about 10% of total revenue last year to 16% this quarter) even as the overall crypto market stayed relatively flat. They now have 26.5 million funded accounts holding $279 billion in total assets, which is up 99% from last year.

Plus they have ~520K new crypto users added through the Bitstamp acquisition and Bitstamp generated $7B in notional crypto trading volume following the closing of the acquisition in June 2025.

The company closed the quarter holding $279 billion in platform assets, which is a 99% increase compared to the previous year, alongside $13.8 billion in net deposits. Funded accounts grew by 10% to reach 26.5 million, while cash sweep balances surged 56% to $32.7 billion, indicating stronger wallet share per customer.

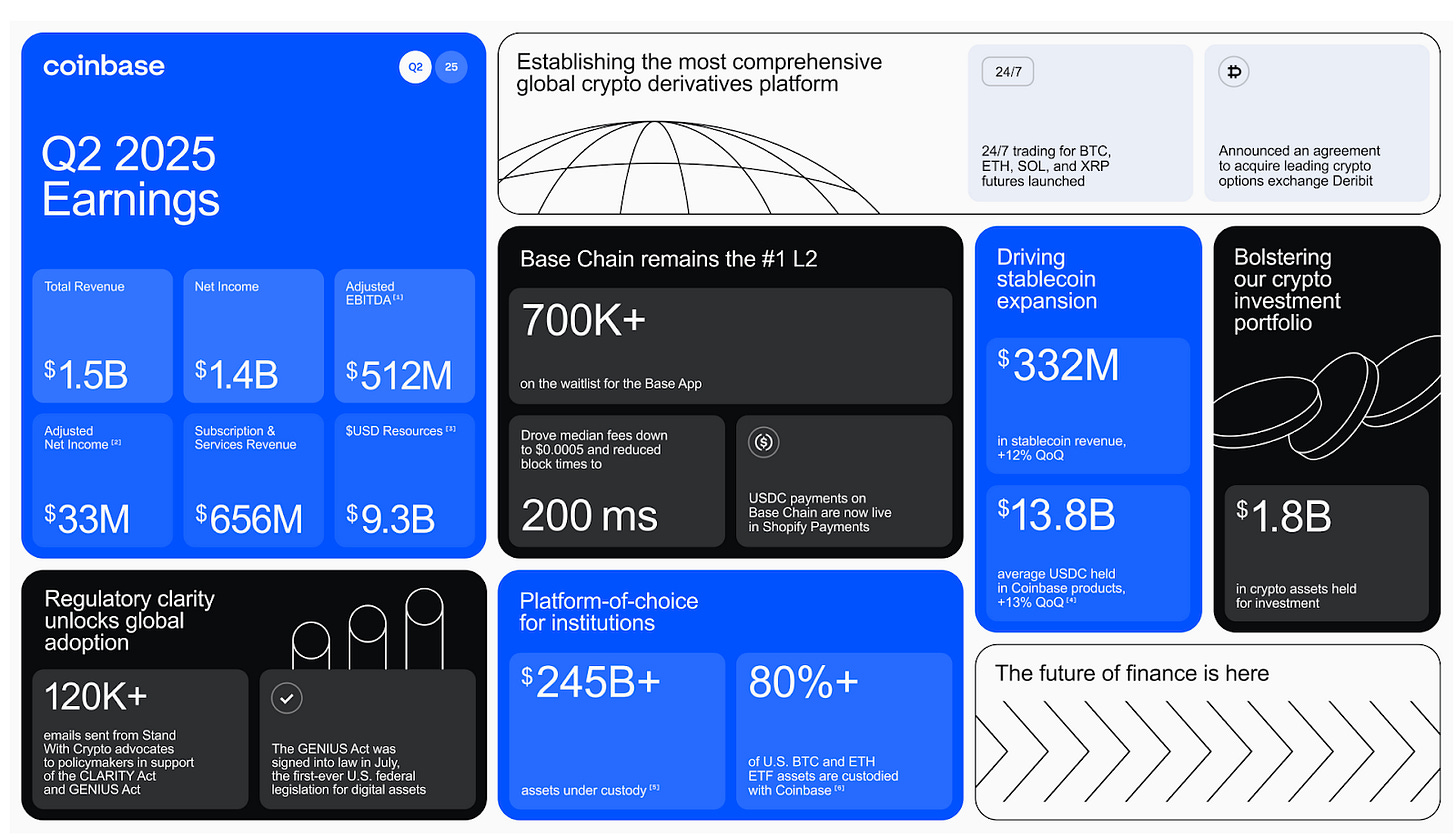

Meanwhile, Coinbase had what polite people would call “a challenging quarter.”

Total revenue dropped 26% from Q1 to $1.5 billion, missing analyst expectations. Transaction revenue fell 39% as retail trading dried up. The stock dropped 16% on earnings day while investors tried to figure out if this was a temporary blip or a sign that people don’t actually want to pay high fees for complexity.

“We still see long-term risks to their growth due to above-average retail transaction fees and increasing competition from platforms like Robinhood,” said Alex Woodard, an analyst at Arca. “Coinbase needs to implement cheaper trading fees and continue to expand its product offering through M&A in order to avoid losing market share.”

But calling this quarter a failure misses the bigger picture.

Coinbase posted $1.4 billion in net income, which was actually higher than their $512 million in adjusted EBITDA due to $1.5 billion in unrealised gains from their investment portfolio and strategic crypto holdings. These paper gains on investments boosted net income far above their core operating performance.

Even after removing those one-off windfalls, adjusted net income came in at a solid $33 million. That’s actual profitability in a soft quarter.

And under the hood, there’s a lot to like. Operating expenses were up, but mostly due to a one-time $307 million hit from the May data breach. Core costs — like tech, admin, and marketing — actually dipped, showing real cost control. Their USDC business continues to hum along, with stablecoin revenue hitting $332 million thanks to a 13% increase in average balances. Custody assets hit an all-time high of $245.7 billion.

Prime Financing balances also hit record levels. This is part of Coinbase Prime, their institutional service that works like a traditional prime brokerage - they provide custody, trading, lending, and financing services to hedge funds, family offices, and other large crypto investors. Prime Financing specifically refers to margin lending, where institutions can borrow against their crypto holdings to make additional trades or investments.

Coinbase kept shipping: launching new derivatives products, growing their Base chain, and rolling out Coinbase One Card. So yes, revenue was down, but the foundation looks more solid than ever.

Coinbase’s Infrastructure Empire

But Coinbase’s infrastructure play is more sophisticated than it appears. CoinbaseThey

Coinbase custody $245.7 billion for institutions — a record high that represents a substantial chunk of the entire institutional crypto market. When you buy a Bitcoin ETF through your 401k, you’re probably using Coinbase infrastructure.

Coinbase serves as the primary custodian for 80%+ of all U.S. Bitcoin and Ethereum ETFs, controlling about $113.4 billion of the roughly $140 billion in total crypto ETF assets. When BlackRock’s IBIT or Fidelity’s FBTC need somewhere to store billions in Bitcoin, they call Coinbase. When PayPal wants to launch PYUSD stablecoin or when JPMorgan needs crypto payment rails, they use Coinbase’s backend.

Coinbase has over 240 institutional clients, 420+ liquidity providers, and regulatory licenses that most competitors can’t match. Their custody arm is chartered by the New York State Department of Financial Services. The kind of regulatory approval that took years to get and would take competitors years to replicate.

Their “Everything Exchange” strategy is starting to show results beyond just custody. They just launched perpetual futures with up to 10x leverage, bringing derivatives trading that was previously only available on offshore exchanges to US retail traders. They’re integrating decentralised exchanges directly into their app, so you can trade any token that exists on Ethereum or Base without leaving Coinbase.

Their Base layer-2 network processed over 54,000 token launches in a single day, beating Solana. But the real genius is how Base integrates with everything else Coinbase does. ETF providers can use Base for instant settlements, corporations can tokenise assets directly on the network, and retail users get access to the same infrastructure that powers billion-dollar institutions.

Robinhood’s Generational Takeover

While Coinbase is building infrastructure for institutions, Robinhood is executing what might be the smartest long-term play in finance: capturing an entire generation before they get rich.

The similar strategy worked out pretty well. Disney built its empire by capturing the hearts of children in the early 20th century, long before they had wallets. From cartoons to theme parks, Disney became part of childhood itself. And when those kids grew up and started earning money, they brought that loyalty with them. Spending on movies, merchandise, streaming, and vacations. That early emotional bond turned into a multi-generational cash machine.

Robinhood dominates among young investors in ways that should worry traditional brokerages.

Around 50% of Robinhood’s customers are millennials, about 25% are Gen Z and 20% Gen X.

The average Robinhood user starts investing at 19-22 years old, compared to mid-20s for millennials on other platforms and 30s+ for boomers.

Robinhood even guides new users to their first sell action quickly. Not because they want people to trade constantly, but because locking in actual gains creates an emotional hook that keeps users coming back. Once someone makes real money on the platform, even if it’s just $50, they’re psychologically invested in a way that’s hard to break.

Their expansion into everything-finance makes sense in this context.

Robinhood Gold, their $5/month subscription, bundles a credit card with 3% cash back, high-yield savings, retirement matching, and margin discounts. Gold subscribers grew 60% year-over-year to 2 million users. These are people using Robinhood for banking, cards, and retirement.

The platform now holds $279 billion in assets under custody. The platform wants a piece of the “Great Wealth Transfer“ that involves $84-124 trillion in assets moving from boomers to younger generations over the next 20 years.

Over the next two decades, this wealth will pass from boomers to younger generations. No one knows exactly who gets what or when. But Robinhood is betting that if you build habits early, you don’t need to predict inheritance patterns. You just need to be there when the money shows up.

So, who’s actually winning?

Both stocks have similar market caps. $81 billion for Robinhood, $85 billion for Coinbase. In their year-to-date performance, Robinhood is up 135% while Coinbase is up just 30%, and most of that came in the last month.

Bank of America analyst Craig Siegenthaler recently raised his Robinhood price target to $119 while cutting Coinbase from $383 to $369. His reasoning: “Robinhood’s crypto revenues are exploding while Coinbase depends too heavily on volatile altcoin trading that retail users are abandoning.”

Coinbase’s global market share slipped from 5.65% to 4.56% before recovering slightly in July, while Kraken recorded the most significant US market share gains this year. Coinbase faces a classic dilemma: cut prices and hurt margins, or hold firm and risk losing traders. They chose margins by charging fees on previously free stablecoin trades, while Robinhood’s take rates remain roughly 50% lower.

Mizuho just reaffirmed its $120 price target on Robinhood after meeting with CEO Vlad Tenev, citing the firm’s crypto resilience and aggressive push into tokenised stocks.

“We were particularly impressed by the opportunity to tokenise stocks in Europe, move up-market and potentially to teens, 15% of net deposits coming from competitors, focus on NPS / execution as key growth drivers and crypto price inelasticity,” the analysts said.

But Coinbase has institutional credibility.. While other exchanges compete on trading fees, Coinbase is building relationships with the institutions that will determine how crypto integrates with traditional finance over the next decade.

Neither company is going anywhere. They’re serving genuinely different user needs, and both needs are growing. This looks less like winner-take-all competition and more like market segmentation — Robinhood for mainstream finance, Coinbase for crypto infrastructure.

This is a glimpse into two competing theories about how people will interact with money in the future.

One theory says the future of finance will be invisible. Abstracted, easy, built into apps that feel more like lifestyle products than brokerages. Finance becomes ambient. That’s the Robinhood worldview.

Neither is right or wrong. They’re just aimed at different ends of the spectrum. One is trying to win trust through simplicity, the other through architecture.

That’s it for today’s deep dive. See you on Sunday with a bang on product piece.

Until then… Stay focused.

Disclaimer:

- This article is reprinted from [TOKEN DISPATCH]. All copyrights belong to the original author [@thejaswinima">Thejaswini M A]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge